In the fast-paced world of cryptocurrency, new platforms pop up regularly, each claiming to revolutionize how we invest. One name that’s been making waves lately is RCO Finance, a decentralized finance (DeFi) platform that promises to blend artificial intelligence (AI) with crypto trading and real-world asset (RWA) investments. But what exactly is RCO Finance, and is it worth your attention?

As someone who’s spent years analyzing financial platforms, I’m here to break it down for you in a way that’s clear and straightforward, without all the jargon.

What is RCO Finance?

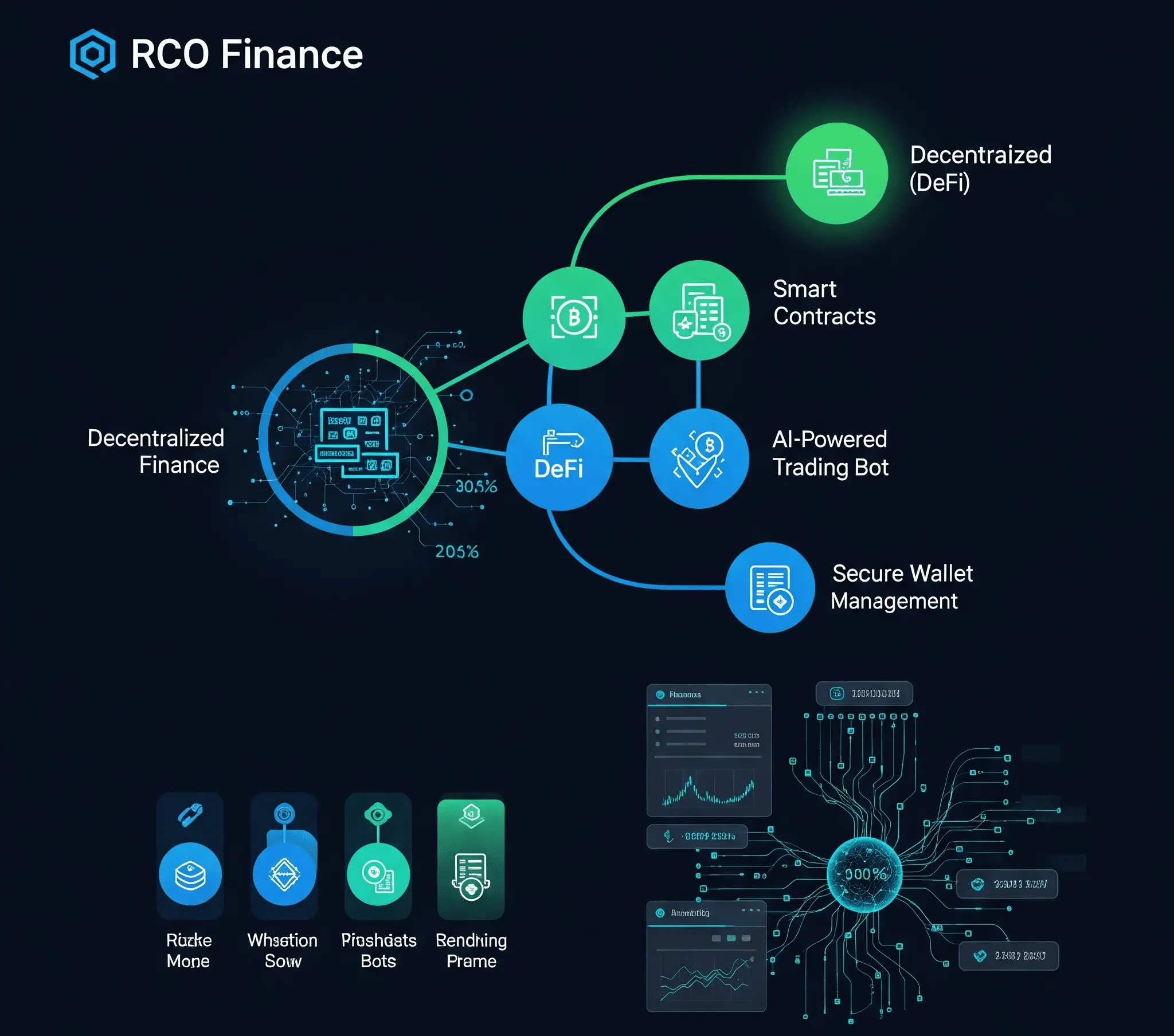

RCO Finance is marketed as an AI-powered DeFi platform that lets users trade a wide range of assets, from cryptocurrencies to tokenized real-world assets like stocks, bonds, and even real estate. Unlike traditional trading platforms that rely on brokers, RCO Finance aims to give users direct control, cutting out middlemen and reducing fees. Its flagship feature is an AI-driven robo-advisor, which supposedly analyzes market data to create personalized trading strategies, promising to maximize returns while minimizing risks.

The platform also boasts staking opportunities with high annual percentage yields (APY), reportedly up to 86%, and leverage options as high as 1000x.

The Appeal of RCO Finance

At first glance, RCO Finance sounds like a dream for crypto enthusiasts. The platform claims to offer access to over 120,000 assets across 12,500 categories, which is a bold promise. This includes not just digital currencies but also tokenized versions of traditional investments, bridging the gap between crypto and conventional finance. For example, you could theoretically trade tokenized shares of companies like Amazon or invest in digital real estate—all from one platform.

The idea of using AI to automate trades is also appealing, especially for beginners who might feel overwhelmed by crypto’s volatility. Plus, the platform’s presale has reportedly raised millions, with some sources citing over $12 million by early 2025, suggesting strong investor interest.

How Does It Work?

RCO Finance operates through its native token, RCOF, which is currently in its presale phase. As of recent reports, the token is priced around $0.10 in stage 5, with projections suggesting it could climb to $0.40–$0.60 upon launch. Investors buy RCOF tokens during the presale, often using Ethereum via wallets like Trust Wallet. Once the platform launches, these tokens can be used for trading, staking, or accessing premium features like discounted trading fees. The platform’s tokenomics allocate 50% of its 800 million token supply to public sales, with the rest earmarked for ecosystem development, liquidity, and rewards.

The signup process is designed to be user-friendly, with no mandatory KYC (Know Your Customer) checks, which speeds things up but might raise eyebrows for some. Security-wise, RCO Finance claims to use SolidProof-verified smart contracts to protect user data and funds, though transparency about the team behind the project remains limited.

The Red Flags

Now, let’s talk about the elephant in the room. Despite its shiny promises, RCO Finance has sparked skepticism in the crypto community. A quick scan of online discussions, particularly on platforms like Reddit, reveals mixed sentiments. Some investors are excited about the potential for 1000x returns, while others label it a potential scam. Here are some concerns that keep popping up:

- Lack of Transparency: The team behind RCO Finance hasn’t publicly identified themselves, which is a red flag in the crypto world. Legitimate projects typically share details upfront to build trust.

- Presale Issues: Some users report sending Ethereum for tokens but not receiving them or getting updates. Others have complained about poor customer service, with chat support being unresponsive or automated.

- Scam Allegations: Online forums like Reddit’s r/CryptoScams have posts warning that RCO Finance resembles other questionable projects like RenQ and Retik Finance, with similar whitepapers and logos. Some users claim the platform’s wallet was drained after presale periods, though these claims are unverified.

- Overhyped Marketing: Articles praising RCO Finance often read like paid promotions, appearing on crypto news sites without much critical analysis. This raises questions about whether these outlets are doing their due diligence.

Is RCO Finance Legit?

It’s tough to say definitively. On one hand, the platform’s features—like AI-driven trading and RWA integration—are innovative and align with DeFi trends. The presale’s success and partnerships with platforms like SolidProof add some credibility. On the other hand, the lack of team transparency, reports of non-delivered tokens, and similarities to other flagged projects are concerning. A domain age check shows rcofinance.com is relatively new, which isn’t a dealbreaker but warrants caution. ScamAdviser gives it a low trust score, citing suspicious server connections and poor customer support.

What Should You Do?

If you’re considering RCO Finance, approach with caution. Here’s my advice as someone who’s seen plenty of crypto projects come and go:

- Do Your Research: Check primary sources like CoinGecko or CoinMarketCap for token listings. If RCOF isn’t there, that’s a warning sign.

- Start Small: If you invest, use a separate wallet with minimal funds to limit risk. Never send crypto to unverified addresses.

- Beware of Hype: Promises of 1000x returns sound tempting but are often unrealistic. Always read the fine print and verify claims.

- Stay Updated: Follow community discussions on platforms like Reddit or X to gauge sentiment. A recent X post from June 2025 claimed a presale delay and muted users asking questions, which isn’t a good look.

Final Thoughts

RCO Finance presents an ambitious vision—merging AI, DeFi, and real-world assets—but its lack of transparency and unresolved red flags make it a high-risk bet. While the potential rewards are enticing, the crypto landscape is riddled with projects that overpromise and underdeliver. Always prioritize research, skepticism, and risk management over hype.

Want deeper dives on crypto innovations and unbiased reviews?

📌 Explore more insights at FlorishLife.com—your trusted guide to navigating the volatile world of finance and tech.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing.