Buying a new car is exciting, but figuring out how to pay for it can feel overwhelming. With Kia’s reputation for affordable, stylish vehicles like the Telluride, Sorento, or EV6, many buyers turn to Kia Financing to make their dream car a reality. At Florish Life, we’re here to simplify the world of auto financing, helping you understand how Kia Financing works, its benefits, and what to watch out for.

Whether you’re eyeing a new Kia or a certified pre-owned model, this guide breaks down everything you need to know about Kia Financing in a clear, approachable way.

What is Kia Financing?

Kia Financing refers to the auto loan and lease options provided by Kia Finance America (KFA), the financial arm of Kia Motors. KFA partners with dealers to offer financing for new, used, and certified pre-owned Kia vehicles. Whether you want to buy outright or lease for flexibility, Kia Financing aims to make ownership accessible with competitive rates and flexible terms.

According to Experian’s Q3 2024 data, the average auto loan for a new vehicle is about $40,634, and Kia’s financing options are designed to fit a range of budgets, often with lower rates than traditional banks, as seen in posts on X where buyers secured rates as low as 4.2% compared to credit unions’ 7-8%.

How Does Kia Financing Work?

Kia Financing operates through dealerships and the KFA website (www.kiafinance.com). Here’s a step-by-step look at the process:

- Choose Your Kia: Visit a Kia dealership to select your vehicle, whether it’s a new Sportage, a used Soul, or a certified pre-owned Niro. Dealerships like Folsom Lake Kia offer online financing applications to jumpstart the process.

- Apply for Financing: Submit a credit application through the dealer or online at kiafinance.com. You’ll need to provide details like income, employment history, and debt-to-income ratio.

- Credit Check: KFA typically uses Experian for credit pulls, relying on FICO Auto Score 8, though this can vary by region. A minimum credit score of around 600 is often required, but higher scores (700+) secure better rates.

- Select Terms: If approved, you’ll choose between a loan (to own) or a lease (to rent). Loan terms typically range from 36 to 72 months, with average APRs of 6.67% for new cars and 8.99% for used, per Experian’s Q3 2024 data.

- Finalize and Pay: Sign the agreement, make any down payment (averaging $6,619 for new Kias), and set up payments through kiafinance.com or automatic debits.

Payments can be made online, via an automated phone system (866-498-4455, $3.95 fee), or by mail to Kia Finance America’s Dallas addresses. Note that credit card payments aren’t accepted directly, but you can use Visa/MasterCard via Western Union Quick Collect with fees.

Benefits of Kia Financing

Kia Financing offers several advantages that make it appealing for car buyers:

- Competitive Rates: KFA often provides lower APRs than banks or credit unions, especially during promotional periods. For example, a buyer on X reported securing a 4.2% rate with an 800+ FICO score, beating local credit unions.

- Flexible Options: Choose between loans for ownership or leases for lower monthly payments and the ability to upgrade every few years. Kings Kia highlights how their finance team helps buyers weigh these options.

- Robust Warranties: New Kias come with a 10-year/100,000-mile powertrain warranty, 5-year/60,000-mile basic warranty, and roadside assistance, adding value to financed purchases. Certified pre-owned Kias include a 1-year/12,000-mile platinum coverage.

- Convenient Tools: The Kia Owners Portal (owners.kia.com) lets you manage payments, view maintenance schedules, and access digital manuals, making ownership seamless.

- Skip-a-Payment Option: After six consecutive on-time payments, you may skip one payment per year (with interest accruing), offering relief during financial hiccups.

These perks make Kia Financing a strong choice for buyers seeking affordability and support, especially for models like the budget-friendly 2025 Kia Rio, starting at $20,000.

Types of Kia Financing

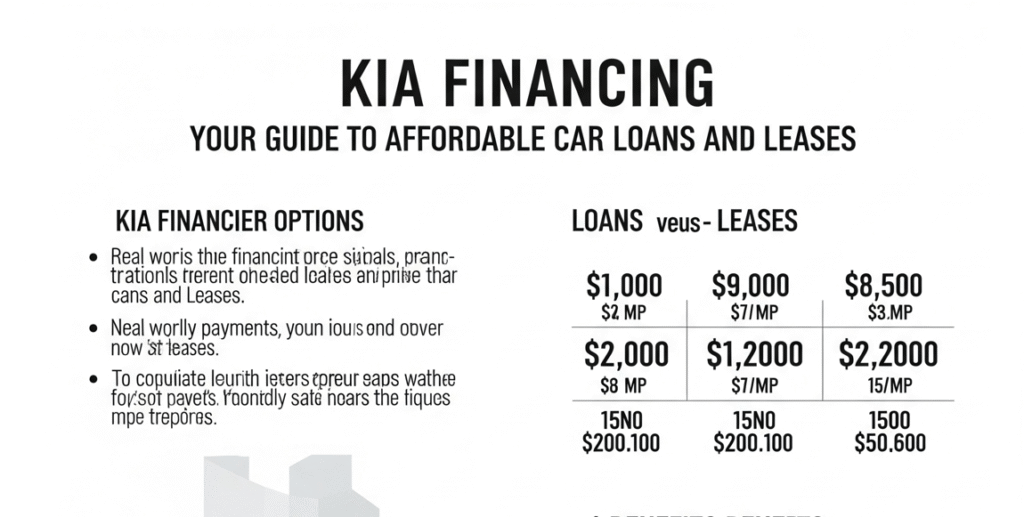

Kia Financing offers two main paths: loans and leases. Here’s how they compare:

- Auto Loans: Ideal for those who want to own their Kia. Payments are higher but build equity, and you can refinance later for better rates, as one Reddit user did, dropping from 4.75% to 3.49% with a credit union. Terms range from 36 to 72 months, with shorter terms reducing total interest but increasing monthly payments.

- Leases: Perfect for drivers who prefer lower monthly payments and want to upgrade every 2-3 years. Leases include maintenance costs but require you to cover taxes like property or excise tax based on your location. You can buy the vehicle at lease-end using a payoff check.

Your choice depends on your budget and driving habits. A 2024 LendingTree study found that shorter loan terms (e.g., 48 months) save on interest but raise monthly payments, which is key for high-credit borrowers.

Challenges and Considerations

While Kia Financing has clear benefits, there are some hurdles to watch for, based on user feedback and industry insights:

- Customer Service Issues: Reviews on WalletHub and Reddit highlight inconsistent support, with complaints about delayed lien releases, unreturned calls, and bounced refund checks. One user lost a $3,000 car sale offer due to a 20-day delay in receiving a lien release.

- Late Payment Risks: Missing payments by even a few days can incur late fees, and prolonged delinquency may lead to repossession, as one Uber driver experienced after a payment dispute. Contact KFA immediately if you’re struggling to explore forbearance or payment plans.

- Credit Requirements: A credit score below 600 may result in higher APRs or rejection. Factors like income and debt-to-income ratio also matter, so check your credit report before applying.

- Website Glitches: Some users report issues with kiafinance.com, like double billing or slow payment processing, which can take 5-7 days to reflect in your bank account.

These challenges underscore the importance of staying proactive—monitor your account, keep records, and contact KFA at (866) 644-1350 for issues.

Tips for Getting the Best Kia Financing Deal

To make Kia Financing work for you, consider these strategies:

- Check Your Credit: A score of 700+ can secure rates as low as 4%, while scores near 600 may face 8-10% APRs. Use free tools like Credit Karma to review your Experian report.

- Compare Rates: Shop around with credit unions or banks before committing. A Reddit user refinanced with NFCU for a 1.26% lower rate just 10 days after taking Kia’s offer.

- Leverage Promotions: KFA often runs specials, like 0% APR on select models (e.g., Forte), which expire periodically (e.g., 9/5/2023). Check kiafinance.com for current offers.

- Make a Larger Down Payment: The average down payment is $6,619 for new Kias. Increasing it lowers your loan amount and interest.

- Go Paperless: Enroll in KFA’s paperless program for email notifications and automatic payments, reducing missed payments.

A 2024 Kelley Blue Book analysis found that comparing lender offers can save buyers up to $1,200 over a loan’s life, making research critical.

Is Kia Financing Right for You?

Kia Financing is a solid option if you’re looking for competitive rates, flexible terms, and the backing of Kia’s robust warranties. It’s especially appealing for buyers with good credit or those eyeing promotional deals. However, customer service issues and potential website glitches mean you’ll need to stay vigilant. If you’re considering a Kia, weigh KFA against other lenders, factor in your credit score, and explore lease versus loan options to match your lifestyle.

For example, a hypothetical buyer financing a $30,000 Kia Sorento with a $6,619 down payment and a 60-month loan at 6.67% APR would pay about $465 monthly. With a higher credit score and a shorter 48-month term, payments could rise to $550 but save $800 in interest. Always read the fine print and contact your dealer for clarity on terms.

Final Thoughts

Kia Financing offers a practical path to owning or leasing a Kia, blending affordability with convenience. From competitive rates to tools like the Kia Owners Portal, it’s designed to simplify the car-buying journey. But with reported challenges like delayed refunds or repossession risks, it’s not perfect. By checking your credit, comparing offers, and staying proactive, you can make Kia Financing work for you.

At Florish Life, we’re dedicated to empowering you with clear, actionable insights to navigate financial decisions. Explore more tips on thriving financially at Florish Life.